On Saturday, May 16, the San Francisco Theological Seminary, which has been a Presbyterian theological institution for the past 150 years, filed a judicial complaint with the Presbyterian Church (U.S.A.). Invoking the ecclesiastical jurisdiction of the church’s courts, the seminary’s complaint affirmed its longstanding ties with the Presbyterian Church and its continued devotion to the interests of American Presbyterianism. The complaint was occasioned by a decision by the church’s Committee on Theological Education to remove the seminary from the church’s list of Presbyterian theological institutions.

Last year, the seminary merged with the University of Redlands, a non-sectarian university with a campus in Redlands, California. The seminary’s trustees believed that uniting with Redlands was the best way to preserve the seminary’s existence long-term. While both parties to the merger pledged their strong interest in retaining the seminary’s ties to the Presbyterian church, the church committee secretly adopted new rules after the merger that would rule out non-sectarian merger partners.

The seminary’s complaint charges that only the General Assembly of the church has the authority to determine the seminary’s status, and the committee exceeded its authority. The 224th General Assembly of the Presbyterian Church (U.S.A.) is scheduled to convene next month. Due to the COVID-19 pandemic, plans are being made to hold a “virtual” meeting of the church council. The committee has submitted a “recommendation” to the gathering that asks the church to approve its new rules without explaining that it has already applied them, without authority, to expel the seminary from the denomination.

Supporters of the seminary note that the committee’s action, if left standing, would end the church’s relationship with its only seminary located west of the Rocky Mountains. The denomination is based in Louisville, Kentucky. The committee’s expulsion of the seminary, and its application to next month’s General Assembly, are causing an uproar among Presbyterian churches with links to the seminary, particularly in the western United States. They are concerned about the committee’s assumption of powers that belong to the entire church, and worried that it sets a precedent that leaves all of the denomination’s theological institutions at risk. A copy of the complaint may be downloaded here.

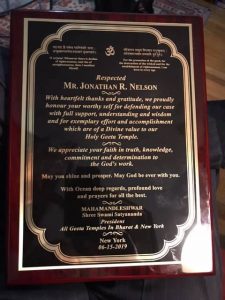

The seminary is represented by Nelson Madden Black partner Jonathan Robert Nelson, who is a ruling elder in the Presbyterian Church (U.S.A.).

In the August edition of the Religion Law column in the New York Law Journal, partners Barry Black and Jonathan Robert Nelson discuss three recent SCOTUS decisions that show strong support behind religious freedom. The analysis of these cases provide some clarity and guidance to all types of religious organizations on matters such as school aid, employment discrimination and contraceptives.

In the August edition of the Religion Law column in the New York Law Journal, partners Barry Black and Jonathan Robert Nelson discuss three recent SCOTUS decisions that show strong support behind religious freedom. The analysis of these cases provide some clarity and guidance to all types of religious organizations on matters such as school aid, employment discrimination and contraceptives.

In the March edition of the Religion Law column in the New York Law Journal, partner

In the March edition of the Religion Law column in the New York Law Journal, partner  In the November edition of their latest New York Law Journal Religion Law column, Barry Black and Jonathan Nelson discuss a tax exemption that may be a little lesser known than the parsonage allowance but might provide significant tax relief to qualifying congregations.

In the November edition of their latest New York Law Journal Religion Law column, Barry Black and Jonathan Nelson discuss a tax exemption that may be a little lesser known than the parsonage allowance but might provide significant tax relief to qualifying congregations.